Emerging Markets Poised for Bull Run

Emerging markets are gaining traction as investment destinations, fueled by a growing "sell U.S." narrative. Bank of America has identified emerging markets as the "next bull market," citing a weaker U.S. dollar, peaking U.S. bond yields, and China's economic recovery. JPMorgan has also upgraded emerging market equities, encouraged by easing U.S.-China trade tensions and attractive valuations.

Shifting Investor Confidence

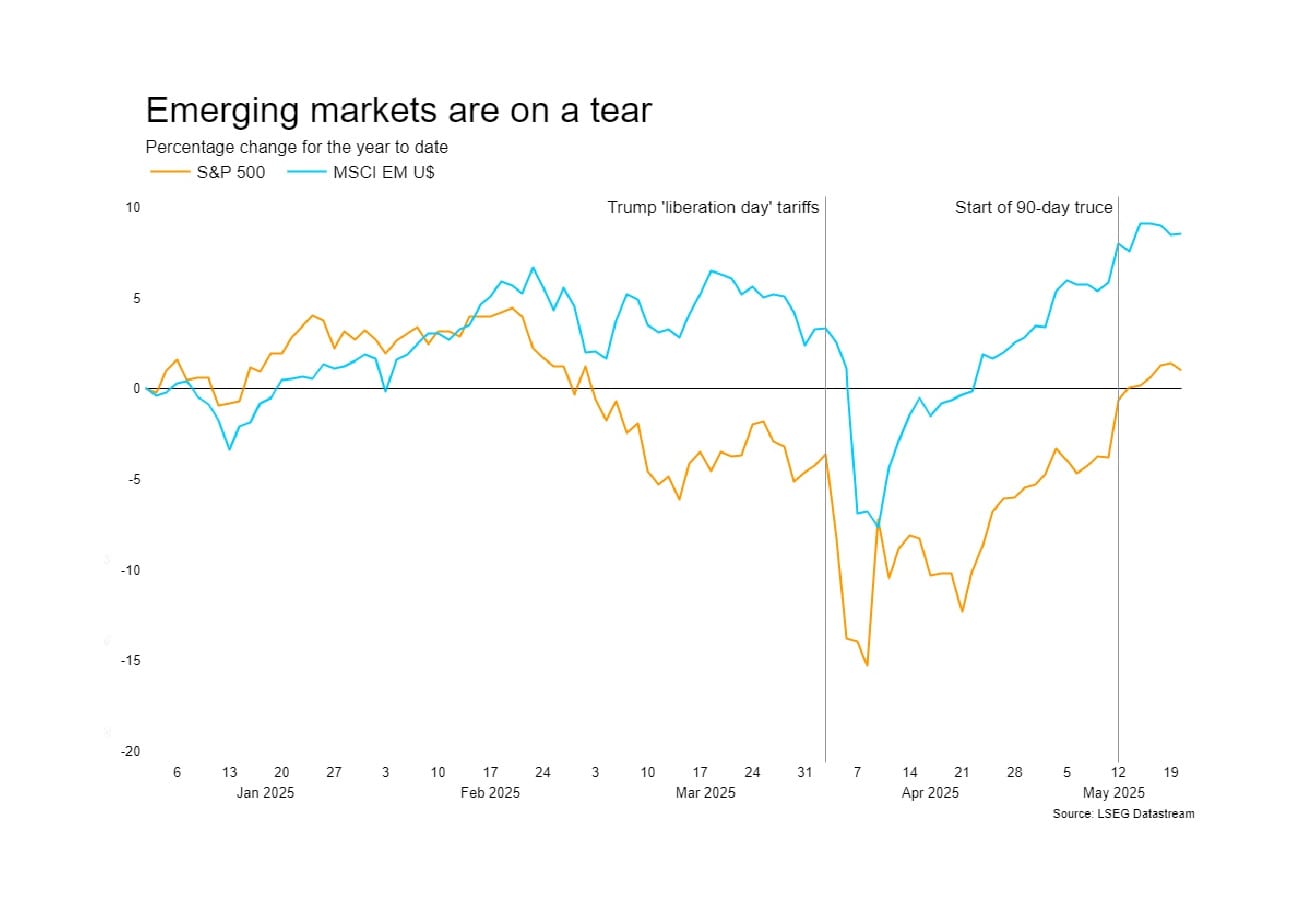

The shift is partly due to declining confidence in U.S. assets, triggered by events such as Moody's downgrade of the U.S. credit rating and a sell-off in U.S. Treasuries. The MSCI Emerging Markets Index has outperformed the S&P 500 year-to-date, highlighting this trend.

Expert Perspectives

According to Malcolm Dorson of Global X ETFs, U.S. investors are under-allocated to emerging markets, presenting an opportunity for future growth. He points to India and Argentina as promising markets, while sovereign upgrades in countries such as Brazil enhance their appeal. Mohit Mirpuri of SGMC Capital suggests that investors are seeking diversification and long-term returns in emerging markets after years of U.S. outperformance.

A Sustainable Rally?

Ola El-Shawarby from VanEck believes this emerging market rally could be different from previous ones due to deeply discounted valuations, low investor positioning, and structural progress in key markets.