Australia Cuts Interest Rates to 2-Year Lows Amid Easing Inflation

Australia

Business & Finance

Australia

Business & Finance

Australia's central bank cuts interest rates to 3.6%, a 2-year low, due to easing inflation. The move aims to boost the slowing Australian economy.

Australia Cuts Interest Rates to 2-Year Lows

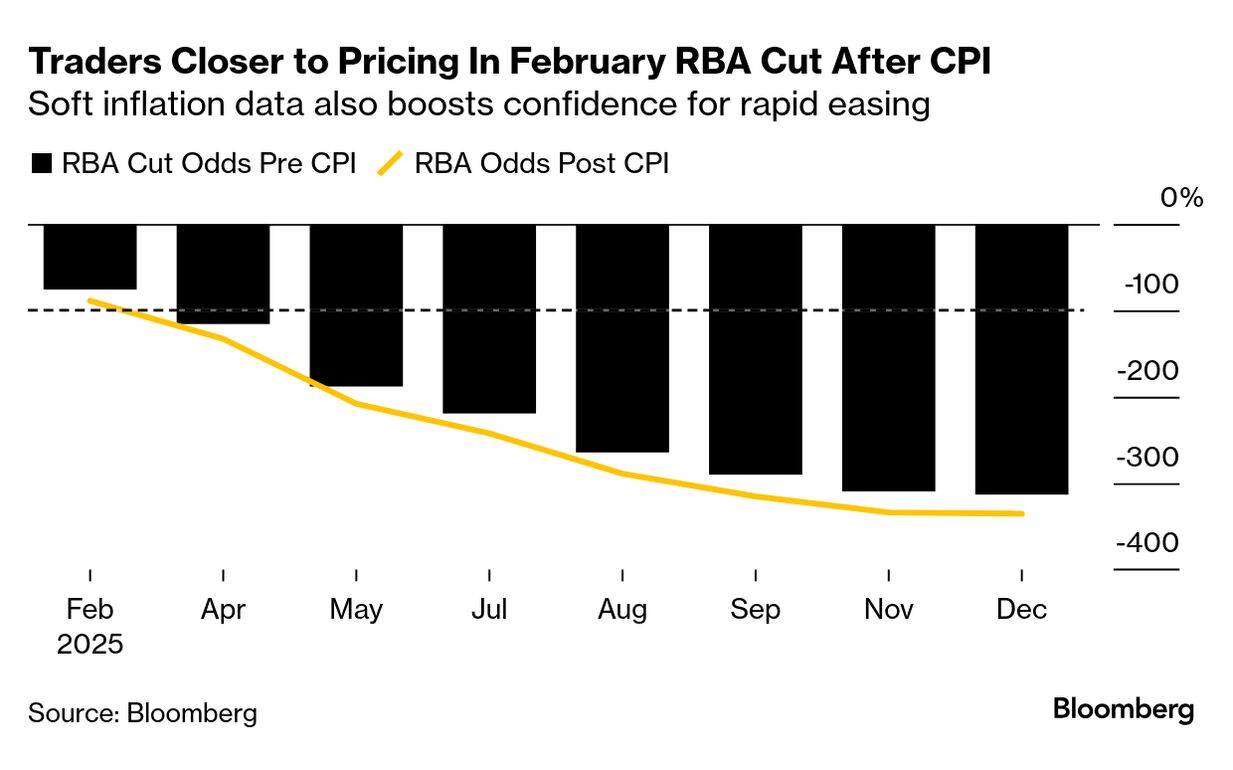

The Reserve Bank of Australia (RBA) has lowered its policy rate by 25 basis points, bringing it to 3.6%, the lowest since April 2023. This decision aligns with economists' expectations.

Reasons for the Rate Cut

Easing inflation provides the RBA with leeway to stimulate the Australian economy. The central bank acknowledges the financial strain on households but is open to further tightening if inflation resurges.

Inflation and Economic Growth

Inflation has significantly decreased from its 2022 peak, reaching 2.1% in the second quarter, nearing the RBA's target range of 2%-3%. However, first-quarter economic growth was 1.3% year-on-year, below projections. Quarter-on-quarter growth was 0.2%, short of expectations.

Factors Affecting Growth

Weaker public spending, consumer demand, and exports contributed to this slowdown.

Future Outlook

Analysts at the Commonwealth Bank of Australia anticipate another rate cut in November and potentially one more in early 2026.