Sudan's Civil War: Who Controls its Oil, Gold, and Agricultural Wealth Amidst Devastating Conflict?

Sudan

Conflict & Resources

Sudan

Conflict & Resources

Sudan's ongoing civil war between the army and RSF fuels the world's largest displacement crisis. This analysis details who controls the nation's vital oil, gol

Sudan's Warring Factions Battle for Control of Vital Oil, Gold & Agricultural Riches

The devastating civil war in Sudan, now in its third year, continues to rage between the Sudanese Armed Forces (SAF) and the paramilitary Rapid Support Forces (RSF), plunging the nation into a profound humanitarian crisis. This conflict has resulted in the world's largest displacement crisis, with over 9.5 million people uprooted from their homes across Sudan's 18 states, and millions more facing severe food insecurity. Beneath the surface of this struggle for power lies a battle for control over Sudan's vast natural wealth—oil, gold, and fertile agricultural lands—resources that could otherwise alleviate the suffering of its people.

A Nation Divided: Control of Key Territories

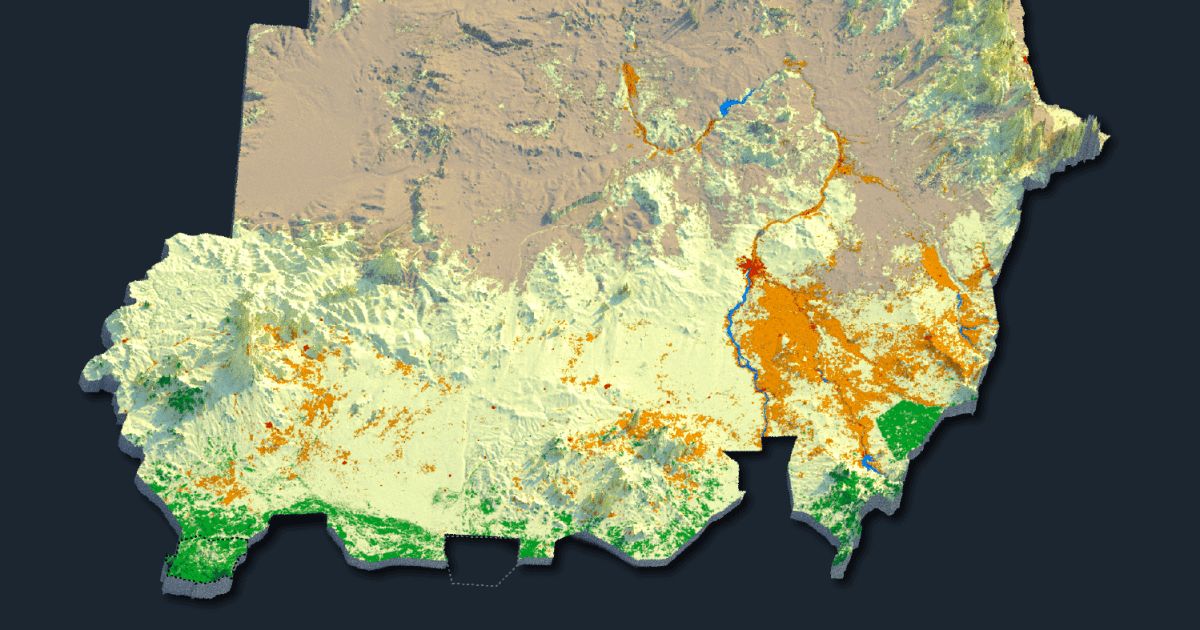

The geographic control in Sudan is sharply divided. The Sudanese army largely maintains its stronghold over much of the north and east, including the capital city, Khartoum, other vital cities along the Nile River, and the strategic Port Sudan on the Red Sea coast. Conversely, the RSF has solidified its dominance in the western Darfur region. A significant victory for the RSF came on October 26, when they captured el-Fasher, the capital of North Darfur state, after an 18-month siege.

Sudan's Economic Lifelines: Exports at a Glance

Despite the ongoing turmoil, Sudan possesses significant export potential, primarily driven by three key sectors: oil, gold, and agricultural products. In 2023, the country's total exports reached $5.09 billion. Crude oil led the way with $1.13 billion, followed closely by gold at $1.03 billion. Animal products contributed $902 million, while oilseeds, predominantly sesame, accounted for $709 million (with sesame alone bringing in $613 million). Gum arabic, crucial for global food, beverage, pharmaceutical, and cosmetic industries, generated $141 million. Notably, Sudan stands as the world's largest exporter of both sesame seeds and gum arabic.

The Agricultural Heartlands: A Battle for Sustenance

Sudan's agricultural landscape is intrinsically linked to the Nile River, whose annual floods replenish the fertile lands. The confluence of the White and Blue Niles in Khartoum marks a significant agricultural zone. Roughly 51.4 percent of Sudan is covered in grazing lands, primarily in the southern regions stretching up to Khartoum. These rangelands are highly coveted for their ability to support robust herding and animal husbandry industries, with control currently shared relatively equally between the SAF and RSF. A critical strip within the northern rangelands is the "gum arabic belt," home to the acacia trees that yield this valuable resin. Sudan's most productive croplands are concentrated between the Blue and White Niles, particularly in Gezira state, an area presently under the control of the armed forces.

Petroleum: The Shifting Sands of Oil Control

Oil exports have historically been Sudan's primary revenue source. Production peaked between 2001 and 2010, reaching nearly 500,000 barrels per day. However, output dramatically fell after South Sudan's secession in 2011, which saw 75 percent of Sudan's oil reserves move with the new nation. By 2023, production had plummeted to 70,000 bpd. Despite this decline, crude oil remained a top export in 2023, valued at $1.13 billion, making Sudan the world's 40th largest crude exporter. Major buyers included Malaysia ($468 million), Italy ($299 million), Germany ($125 million), China ($105 million), Singapore ($80.3 million), and India ($51.4 million).

As of 2024, Sudan's estimated oil reserves stand at 1.25 billion barrels, alongside 3 trillion cubic feet of natural gas, though gas production and consumption remain minor. Most of Sudan's oilfields are strategically located in the south, near the border with South Sudan, maintaining strong ties between the two countries' oil sectors. Many of these southern fields are currently under RSF command. The industry relies on five refineries in the central and northern regions. The largest, the Khartoum refinery (100,000 bpd capacity), was held by SAF as of late January 2025, as is the smaller Port Sudan refinery. The critical pipelines transporting crude from southern fields to the Bashayer export terminal south of Port Sudan, vital for both Sudanese and South Sudanese oil, largely remain under army control, particularly the line from el-Obeid to Port Sudan.

Gold: A Lucrative, Contested Asset

Sudan ranks among Africa's leading gold producers, with significant deposits scattered across its northeast, central, and southern regions. While the Sudanese army controls most of the eastern deposits, the central and southwestern goldfields are predominantly under RSF authority. A substantial portion of gold extraction comes from artisanal and small-scale mining, employing hundreds of thousands but often operating outside governmental oversight. Since the war began in 2023, control over these gold mines and their trade routes has become a vital funding source for both warring factions. Local reports indicate a surge in gold production to 64 tonnes in 2024, a 53 percent increase from 41.8 tonnes in 2022, generating $1.57 billion in legal export revenues. The conflict also fuels an unquantified black-market trade.

In 2023, the United Arab Emirates emerged as the primary buyer of Sudanese gold, importing over 99 percent of the $1.03 billion in gold exports. Overall, approximately 80 percent of Sudan's exports head to Asia, 11 percent to Europe, and 8.5 percent to Africa. The UAE was Sudan's top trade partner in 2023, importing $1.09 billion (21 percent of total exports), almost entirely gold. China followed, importing $882 million (17 percent), mainly vegetable products. Saudi Arabia ($802 million, 16 percent, mostly livestock), Malaysia ($470 million, 9 percent, primarily crude petroleum), and Egypt ($387 million, 7.6 percent, mixed goods) complete the top five, collectively accounting for over two-thirds of Sudan’s exports.

Sudan: A Demographic and Geographic Snapshot

As Africa's third-largest country, spanning approximately 1.9 million square kilometers (718,000 sq miles), Sudan had a population of 50.5 million in 2024. The majority of its residents live along the Nile River and in urban centers. The Greater Khartoum area is home to about seven million people, and Nyala in South Darfur has almost 1.15 million. Other significant cities include el-Obeid (560,000), Port Sudan (547,000), Kassala (411,000), Gadarif (364,000), el-Daein (265,000), el-Fasher (253,000), ad-Damazin (186,000), Geneina (163,000), Gereida (120,000), and Atbara (108,000).