Canada's Debt Issuance to Hit Record High Amid Budget Delay

Canada

Finance

Canada

Finance

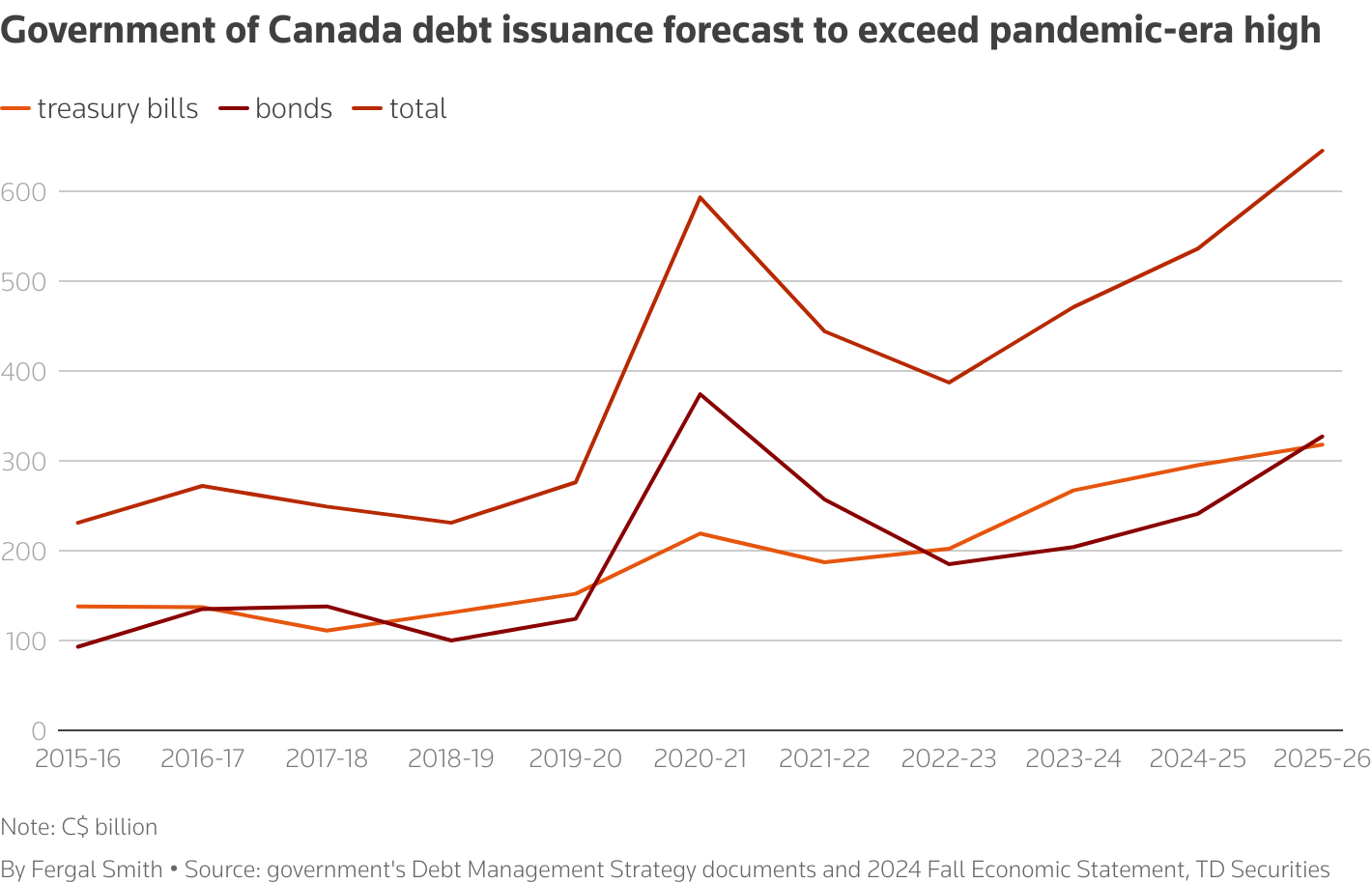

Canada's government debt issuance is projected to exceed pandemic levels, potentially raising borrowing costs and pressuring fiscal transparency. Budget delayed

Canada's Debt Issuance to Hit Record High

Canada is facing a potential record high in government debt issuance this fiscal year, exceeding levels seen during the pandemic.

Key Concerns and Projections

This surge in borrowing could lead to increased borrowing costs and intensify pressure on the Liberal Party to enhance transparency regarding their spending strategies. Prime Minister Mark Carney plans to present the budget in the fall, a delay from the typical April unveiling.

Analysts and investors are concerned that the budget might reveal unforeseen spending increases, requiring the market to absorb a higher volume of bond issuances within a compressed timeframe.

Economic Context

Given that approximately 75% of Canada's exports are directed to the United States, the nation's fiscal outlook faces uncertainty amidst the ongoing U.S. global trade war.

Despite these concerns, analysts estimate Canada's borrowing needs for 2025-26 to be around C$628 billion, exceeding the C$593 billion issued in 2020-21.

Market Impact

Investors are likely to demand higher returns to compensate for the risks associated with larger loans. TD Securities forecasts a steeper yield curve in Canada and debt issuance of C$645 billion this fiscal year.

The Canadian 10-year yield has already risen to 3.31%, mirroring trends in U.S. yields due to concerns about U.S. government debt demand.