Tesla Stock Slide: Market Risks from Trump-Musk Influence?

United States

Finance

United States

Finance

Tesla stock's recent slide raises concerns about market risks stemming from the influence of figures like Trump and Musk. Analysts examine the impact.

Tesla Stock Slide: Market Risks Examined

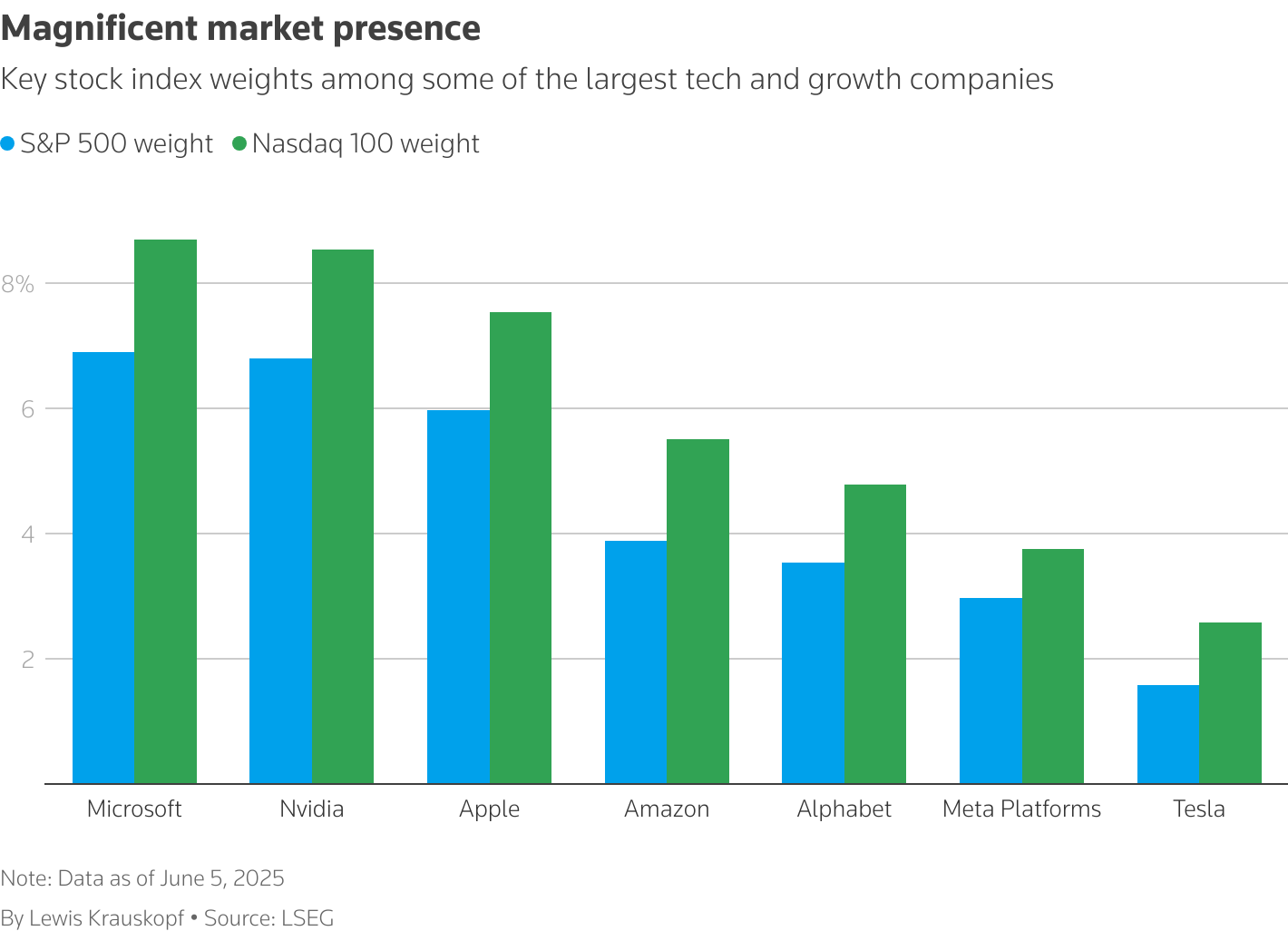

Recent volatility in Tesla's stock price has sparked concerns about the broader market's susceptibility to the influence of high-profile figures like Elon Musk and Donald Trump.

Analyst Observations

Market analysts are closely examining how pronouncements and actions by such individuals can create instability and impact investor confidence, particularly in companies with significant public profiles and large market capitalizations.

Key Takeaways

The Tesla case highlights the potential for rapid shifts in valuation driven by factors beyond traditional financial metrics, raising questions about risk assessment and portfolio management strategies.