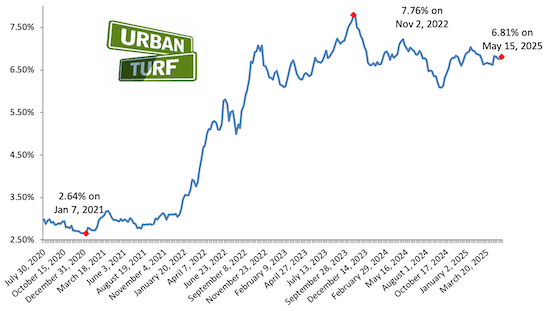

Mortgage and Refinance Rates Drop Amid Deficit Concerns

On June 25, 2025, mortgage interest rates saw a decrease, influenced by growing concerns over the U.S. deficit.

Current Mortgage Rate Overview

According to Zillow, the average 30-year fixed mortgage rate dropped by five basis points to 6.62%, while the 15-year rate fell by three basis points to 5.85%. This occurred as the 10-year Treasury yield reached its lowest point since May 7, despite worries about the national debt.

Federal Reserve Stance

Federal Reserve Chairman Jerome Powell has reiterated a "wait and see" approach, signaling no immediate interest rate cuts.

Current Rate Data

Here's a snapshot of current mortgage rates:

- 30-year fixed: 6.62%

- 15-year fixed: 5.85%

- 5/1 ARM: 6.97%

Mortgage Refinance Rates

Refinance rates are slightly higher:

- 30-year fixed: 6.71%

- 15-year fixed: 5.95%

- 5/1 ARM: 7.44%

30-Year vs. 15-Year Mortgages

The advantage of a 30-year mortgage is lower, predictable payments. A 15-year mortgage offers lower interest rates and a faster payoff. Consider your financial goals to determine which is best for you.

Adjustable-Rate Mortgages (ARMs)

Adjustable-rate mortgages (ARMs) provide lower initial rates but carry the risk of future rate increases. Carefully evaluate the risks before opting for an ARM.

Securing Lower Refinance Rates

Improving your credit score and lowering your debt-to-income ratio are crucial steps for securing lower refinance rates.