Berkshire Hathaway's Surprise Alphabet Stake & Buffett's Succession Plan: A New Era

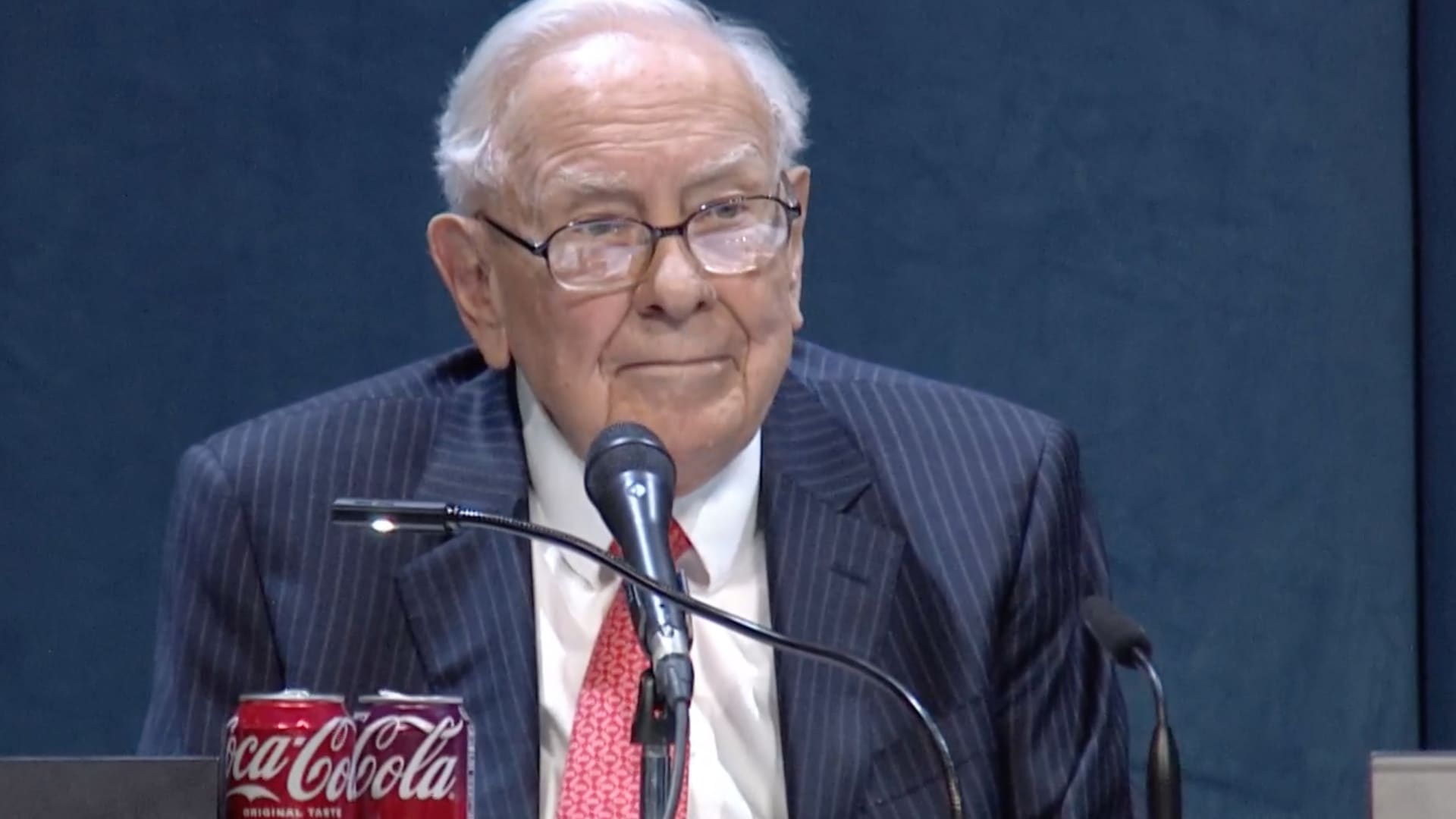

Berkshire Hathaway, the investment conglomerate helmed by legendary investor Warren Buffett, recently disclosed its third-quarter equity portfolio, revealing a significant and somewhat unexpected new investment. The "Oracle of Omaha" may be "going quiet" as he prepares to cede more responsibilities, but his company's latest moves certainly aren't.

A Bold New Tech Bet on Alphabet

The standout revelation from Berkshire Hathaway's Q3 13F filing was the acquisition of over 17.8 million Class A shares in Alphabet, Google's parent company. Valued at approximately $4.9 billion, this makes it the largest dollar-value addition to Berkshire's portfolio during the quarter. The news immediately sent Alphabet's stock climbing 3.5% in after-hours trading.

The identity of the decision-maker behind this substantial tech investment remains a topic of speculation. While such a large purchase typically bears Buffett's signature, Alphabet's nature—a high-growth tech stock that surged 51.3% year-to-date, including a 37% climb in Q3—doesn't align with Buffett's traditional avoidance of the tech sector (he famously categorizes Apple as a consumer products company). Buffett and Charlie Munger have previously expressed regret for not investing in Google earlier, admitting they "screwed up." This suggests the decision could stem from incoming CEO Greg Abel, who is not bound by past hesitations, or from portfolio managers Ted Weschler and Todd Combs, to whom Buffett has increasingly delegated responsibilities.

Strategic Trims: Apple and Bank of America

While Berkshire added Alphabet, it also strategically reduced its stakes in two long-standing giants: Apple and Bank of America. These reductions were anticipated following hints in Berkshire's earlier 10-Q filing.

Berkshire's Apple holdings saw a cut of nearly 15%, or $10.6 billion, bringing its position down to approximately 238 million shares. Despite this reduction, Apple remains Berkshire's largest equity holding, valued at $64.9 billion and representing 21% of the portfolio's total value. This marks a 74% decrease in Apple shares since Berkshire began selling two years ago.

The Bank of America stake was trimmed by a smaller 6.1%, or roughly $1.9 billion. The remaining 238 million shares, valued at $29.9 billion, solidify its position as Berkshire's third-largest holding, comprising almost 10% of the portfolio. This reduction follows a 43% cut since early last year.

Buffett's Evolving Role: "Going Quiet," "Sort Of"

Beyond portfolio shifts, Warren Buffett himself shed light on his evolving role in his recent Thanksgiving letter. While headlines highlighted his intention to be "'going quiet,'" Buffett notably added the crucial qualifier, "'Sort of.'"

Effective next year, Greg Abel, whom Buffett praised as "a great manager, a tireless worker and an honest communicator," will assume the significant duty of writing the annual letter to shareholders and fielding questions at the annual meeting. Buffett plans to join the other directors on the arena floor. However, he emphasized his commitment to staying connected through his annual Thanksgiving message, providing ongoing insights to shareholders and his children.

This year's Thanksgiving letter, significantly longer than the previous year's, echoed themes familiar to Buffett's decades of writing: the role of luck, the experience of aging, his deep admiration for Berkshire shareholders, and his unwavering confidence in Abel's leadership. A charming anecdote included his childhood escapade of fingerprinting nuns, jokingly preparing for a "someday a nun would go bad" scenario.

Increased Philanthropic Endeavors

A key announcement in the letter involved Buffett's decision to "step up the pace of lifetime gifts" to the three foundations run by his children, aged 72, 70, and 67. This move aims to ensure a significant portion of his estate is distributed before alternate trustees might replace them. Consequently, the Class B shares converted from Class A and gifted to each foundation increased to 400,000 shares from 300,000 last year. Including an unchanged donation to a fourth foundation named after his late wife, the total gifts reached $1.3 billion, a 17% increase from the previous year.